Our Thoughts on Farmers Pet Insurance

We awarded Farmers Pet Insurance a 5-star rating based on our pet insurance methodology, naming it our pick for Farmers members. It offers pet insurance policies in all 50 U.S. states through a partnership with Pets Best, one of the highest-ranked pet insurance companies in our comprehensive review.

Farmers Pet Insurance earned high points in most areas of our methodology, with top marks in the cost, plan types and covered treatments categories. However, Farmers scored low marks for brand reputation, with poor customer ratings across sites such as Trustpilot and the Better Business Bureau (BBB).

It’s worth noting that Pets Best, which partners with Farmers to provide coverage, earned high marks for reputation in our review. Since Pets Best provides insurance coverage for your pet, and not Farmers directly, your customer experience may align with other Pets Best policyholders.

Pros and Cons

How Farmers Scored in Our Methodology

Farmers pet insurance scored 5 out of 5 stars in our review based on our pet insurance methodology. Farmers partners with Pets Best to offer policies to its members. The company earned full points in rating categories such as cost, plans, custom coverage levels and waiting periods, plus bonus points for covered treatments.

Farmers Pet Insurance Plans and Pricing

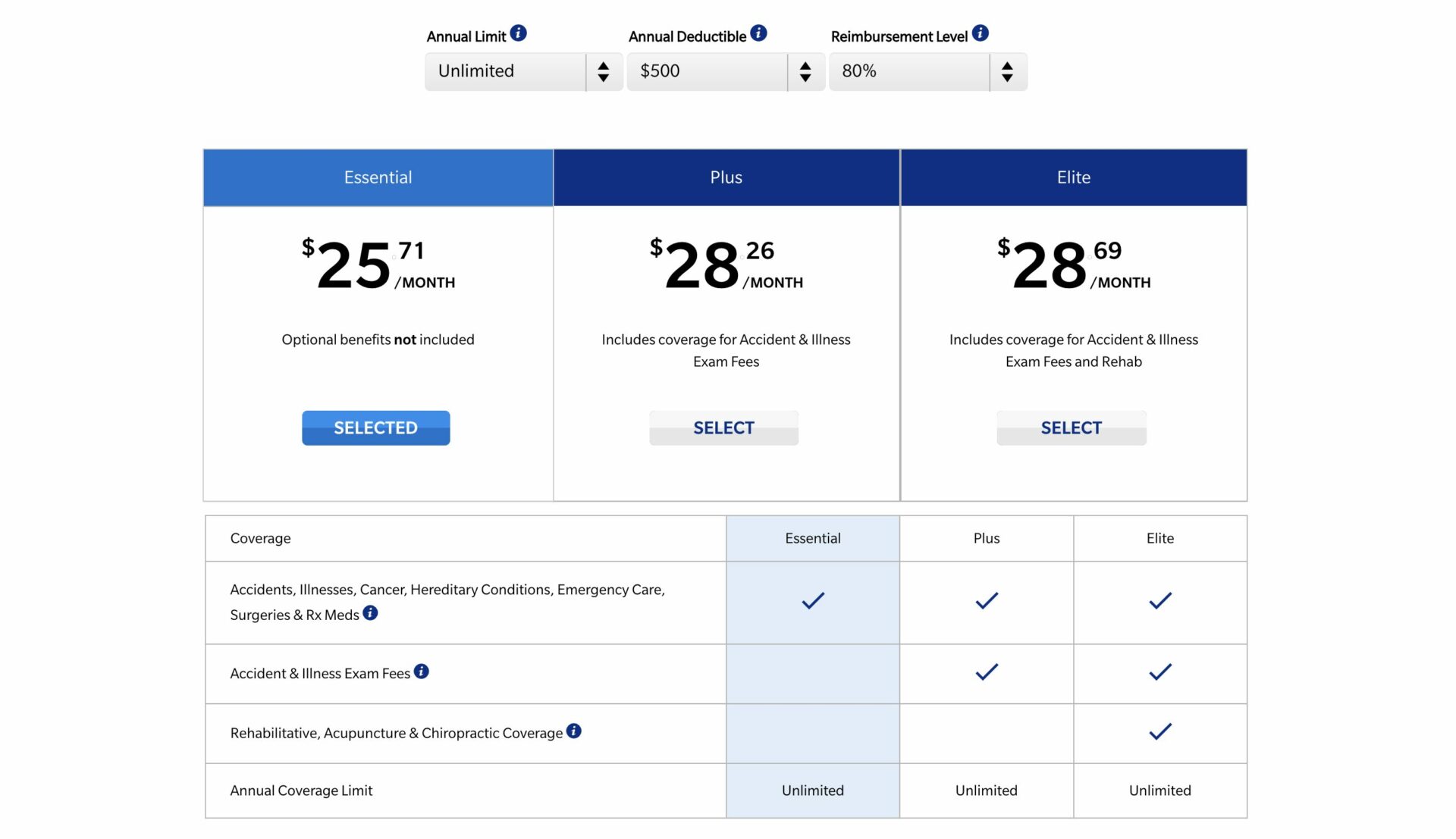

Farmers works with Pets Best to offer pet insurance for cats and dogs over 7 weeks old. Farmers has three major policies to choose from: accident and illness, accident-only or routine wellness care. Our research team went through the quote process to better understand the customer experience. Pets Best provided detailed explanations of each plan it offers through Farmers, making it easy to choose the coverage and add-ons we were looking for.

How Much Does Farmers Pet Insurance Cost?

The cost of a Farmers Pet Insurance policy through Pets Best will depend on your chosen coverage level, location and pet size, breed, age and health history. To better inform our cost ratings, we’ve gathered quotes for four different pet profiles across all 50 U.S. states, including the following:

- A 5-year-old medium, mixed-breed male dog

- A 2-year-old large, golden retriever female dog

- A 5-year-old mixed-breed, male cat

- A 2-year-old Siamese female cat

Based on these pet profiles, we found the average cost of a Farmers Pet Insurance policy through Pets Best is $44 per month. This is lower than the average pet insurance cost of $49 per month across all states. To further break down coverage costs by plan type, we gathered quotes using the profiles above for the BestBenefit Essential, Plus and Elite accident and illness plans offered by Pets Best.

| BestBenefit Essential | BestBenefit Plus | BestBenefit Elite | |

| Average cost | $22 | $24 | $25 |

| Summary | A base-level accident and illness plan that provides comprehensive coverage. It excludes accident and illness exam fees, rehabilitative, acupuncture and chiropractic coverage. | A mid-level plan tier that provides the protections featured in the Essential plan plus coverage for accident and illness exam fees. | The highest level of accident and illness coverage with everything included in the Plus plan with additional rehabilitative, acupuncture and chiropractic coverage. |

*We calculated average costs based on plans with unlimited annual coverage limits, a $500 deductible and an 80% reimbursement rate.

We also used our sample pet profiles to gather cost data for the routine care add-on and accident-only plans. We found that accident-only coverage for cats costs as low as $6 per month, and coverage for dogs costs as low as $9. Customers can add routine care coverage to any plan for an additional $19 to $29 per month.

Farmers Pet Insurance scored the maximum 20% in the cost section of our methodology, with the average score across 27 different providers being 17%. It offers below-average rates for four different pet profiles based on our research, which included gathering quotes for two dogs and two cats. It also scored highly regarding plan customization and coverage types.

What Does Farmers Pet Insurance Cover?

Farmers Pet Insurance offers its policies through Pets Best. The company offers accident and illness plans with three coverage tiers to choose from. You can also find accident-only and routine care plans with this provider. Note that you can’t purchase routine care as a standalone policy — only as an add-on to an accident and illness or accident-only plan.

Accident and Illness Plan Details

Pets Best BestBenefit plans provide three accident and illness coverage levels: Essential, Plus and Elite. Whether your pet breaks a bone or has an ear infection, this policy covers diagnostics, surgeries and treatments related to accidents and illness.

All BestBenefit plans cover the following:

- Hereditary and congenital conditions

- MRI, CAT scans and X-rays

- Medication injections

- Cancer treatments

- Prescription meds

- Emergency care

- Specialist care

- Outpatient care

- Surgeries

- Accidents

- Lab tests

- Illnesses

If you opt for the BestBenefit Plus plan, you’ll receive additional coverage for accident and illness exam fees. If you choose the Elite plan, your pet will also receive coverage for rehabilitative, acupuncture and chiropractic care. All accident and illness plans exclude pre-existing conditions and preventative care items.

Accident-Only Plan Details

The accident-only plan strictly covers pet-related accidents. While this plan does not cover illnesses, it presents a good option if you’re on a budget and still want coverage for an unexpected injury. This plan covers the following accidents and resulting injuries:

- Medical problems directly related to an injury

- Lacerations, cuts and abrasions

- Animal, insect and snake bites

- Hit by a car or moving vehicle

- Foreign body ingestion

- Bone fracture

- Poisoning

- Wounds

- Torn tail

- Trauma

Farmers Optional Add-on Coverage

You have the option to add routine care and wellness coverage to any Farmers Pet Insurance plan administered by Pets Best. The two plans—BestWellness and EssentialWellness—pay a capped amount per year for various routine care services, and you do not need to pay a deductible.

Covered routine care services include wellness exams, microchipping, spay and neuter procedures, teeth cleaning, vaccinations, preventative medication and more. Total annual benefits for each plan amount to the following:

- EssentialWellness: $305

- BestWellness: $535

When gathering the quotes mentioned in our cost section, factors such as breed, size and age did not affect the cost of this add-on coverage. This means a routine care plan for your dog or cat will range from $19 to $29 monthly.

Customizable Coverage Levels

Farmers allows you to customize your policy by choosing an annual deductible, coverage limit and reimbursement rate. These amounts will determine how much you pay for pet insurance each month. For example, selecting a higher annual deductible, lower coverage limit and lower reimbursement rate will reduce your monthly costs. However, you’ll likely end up paying more out-of-pocket for your pet’s vet bills in the event of an emergency.

Deductible Options

Your policy deductible is the amount you must pay before your pet’s insurance provider takes over. So, if you have a $100 deductible, you’ll have to pay $100 annually before insurance coverage kicks in. Note that the higher your deductible, the lower your monthly cost. Farmers offers the following options for pet insurance deductibles: $50, $100, $200, $250, $500 or $1,000.

Reimbursement Rates

The reimbursement rate is the percentage of covered vet expenses your insurance provider will pay out when you file a claim. If you purchase a pet insurance policy through Farmers, you can choose from rates of 70%, 80% or 90%.

Annual Limit Options

Your policy’s annual coverage limit is the maximum amount your provider will pay for claims in a given year. Farmers Pet Insurance offers annual limits of $5,000 or unlimited.

Policy Sign-Up, Claims Filing and Payout Processes

Farmers Insurance makes obtaining a pet insurance quote and signing up for a policy easy, based on our experience. You can use the online quote tool or speak with a customer representative by phone to learn how much a policy will cost you. If you choose to use the quote tool, it will prompt you to answer a few questions about yourself and your pet.

Once you’ve entered the necessary information, you’ll receive quotes for each of Pets Best’s plans. We found it easy to play around with the customization options and find coverage details for each plan. In our experience, Pets Best offers a straightforward, no-fuss quote and purchasing process for pet owners with Farmers Insurance.

If you’ve purchased a pet insurance plan through Farmers Insurance and need to file a claim, you can utilize Pets Best’s mobile app. You’ll need to take a photo of your paid invoice using the mobile app and answer a few questions about your pet’s vet visit to get started. You can check the status of your claim at any time using the app.

If you’d prefer not to use the app, you can submit claims through the online customer portal, email, fax or mail. The customer portal allows you to set up a direct deposit for reimbursement, but if you’d prefer, Pets Best can also pay your vet directly.

Customers, such as this reviewer, have submitted multiple claims to Pets Best over the years and appreciate the ease of the filing process. However, the time it takes for your claim to process may vary. Some reviewers, such as this pet owner, agree with how easy the claims process is but note slower processing times. Another policyholder said it took over 50 business days for their claim to process.

Farmers Waiting Periods and Age Restrictions

Most pet insurance companies, including Farmers, require you to wait a certain period after enrolling before you can file a claim. The waiting period in most states is 14 days after your policy effective date for illnesses, three days for accidents and six months for cruciate ligament events. In North Dakota, the waiting period for cruciate ligament conditions is 30 days.

Note that in Maine, Mississippi, Nebraska, New Hampshire and Washington there is no waiting period for accidents. The waiting period for illnesses is 14 days and the waiting period for cruciate ligament conditions is 30 days.

| Provider | Farmers | Lemonade | Spot | Trupanion |

|---|---|---|---|---|

| Claim Turnaround | 4-7 days | 2-4 days | 5-7 days | 5-7 days |

| Accident Waiting Period | 3 days | 2 days | 14 days | 5 days |

| Illness Waiting Period | 14 days | 14 days | 14 days | 30 days |

| Cruciate Ligament Waiting Period | 30 days | 6 months | 14 days | 30 days |

| Age Limit | 14 years old | 14 years old | None | 14 years old |

What Customers Think About Farmers Pet Insurance

As Pets Best administers Farmers pet insurance plans, we looked at ratings for the company on platforms such as the BBB and Trustpilot. At the time of this writing, Pets Best holds a 2.7 out of 5-star rating with the BBB and a 4 out of 5-star rating with Trustpilot.

To learn more about what customers appreciate and dislike about Pets Best, we combed through recent customer reviews to get a general sense of customer satisfaction. Learn more about what we found below.

What Customers Like

- Good communication: Many customers, such as this one, appreciate how attentive and timely the company is with its responses to questions and claims.

- Hassle-free claims: Several reviewers, such as this customer, have stated their happiness with Pets Best’s claims process, noting that the company is timely about sending email updates.

- Helpful customer service agents: Reviewers note the helpful, friendly and knowledgeable representatives who work for Pets Best.

What Customers Don’t Like

- Rate increases: Policyholders make note of price increases at the time of renewal, with this customer reporting a 30% increase in their premium.

- Slow turnaround time: A handful of pet owners, such as this one, have commented on the time it takes for Pets Best to process a claim, with many reporting a month or longer.

- Denied claims: Some reviewers expressed frustration over denied claims, viewing the services as legitimate and covered under their policies.

We reached out to Farmers Insurance for comment on the negative customer reviews mentioned throughout this guide but did not receive a response.

Compare Farmers To Other Pet Insurance Companies

Use the table below to compare the coverage, costs and more offered by Farmers compared to other leading pet insurance providers.

Farmers vs. Lemonade

Lemonade and Farmers Pet Insurance provide the same reimbursement options, but that is where the similarities end. While Lemonade comes at a lower average price point for cats and dogs, Farmers offers unlimited annual limits and a wider range of deductible options.

| Farmers | Lemonade | |

| Reimbursements | 70%, 80% or 90% | 70%, 80% or 90% |

| Deductibles | $50–$1,000 per year | $100–$500 per year |

| Annual limits | $5,000 or unlimited | $5,000–$100,000 |

| Average cost for dogs | $60 per month | $30 per month |

| Average cost for cats | $29 per month | $16 per month |

Learn more about Lemonade in our Lemonade Pet Insurance Review.

Farmers vs. Spot

Farmers and Spot pet insurance offer accident-only, accident and illness, and wellness plans to pet owners. Both providers offer the same reimbursement rate options and unlimited annual limits. However, on average, Spot is somewhat more expensive overall for both dogs and cats.

| Farmers | Spot | |

| Reimbursements | 70%, 80% or 90% | 70%, 80% or 90% |

| Deductibles | $50 to $1,000 per year | $100 to $1,000 per year |

| Annual limits | $5,000 or unlimited | $2,500–unlimited |

| Average cost for dogs | $60 per month | $74 per month |

| Average cost for cats | $29 per month | $33 per month |

Read more about Spot in our Spot Pet Insurance Review.

Frequently Asked Questions about Farmers Pet Insurance

Farmers Pet Insurance, administered through Pets Best, does not have any upper age restrictions based on our research. This means you can insure your dog or cat from 7 weeks old and up.

After gathering quotes using four different pet profiles, our research team found the average cost of a Farmers pet insurance policy through Pets Best is $44 per month. Your costs will vary based on your pet’s age, breed, size, chosen coverage plan and more.

Yes, there is a general waiting period in most states of 14 days after a policy’s effective date for illnesses, three days for accidents and six months for cruciate ligament events. Your state’s waiting period may differ, so check with Farmers Insurance’s partner, Pets Best, for more information.

You can reach Pet’s Best, which administers Farmers pet insurance plans, at 1-877-738-7237 for any general customer service or claims questions.

Methodology: Our System for Rating Pet Insurance Companies

If you have questions about this page, please reach out to our editors at editors@marketwatchguides.com.